SPECIALISED AREAS

Veterinary Accounting

Carrazzo Consulting provides accountants who specialise in aiding veterinary professionals and clinics. We are committed to having a wealth management approach for all our clients, and we focus on creating strategies based on each client’s needs and objectives.

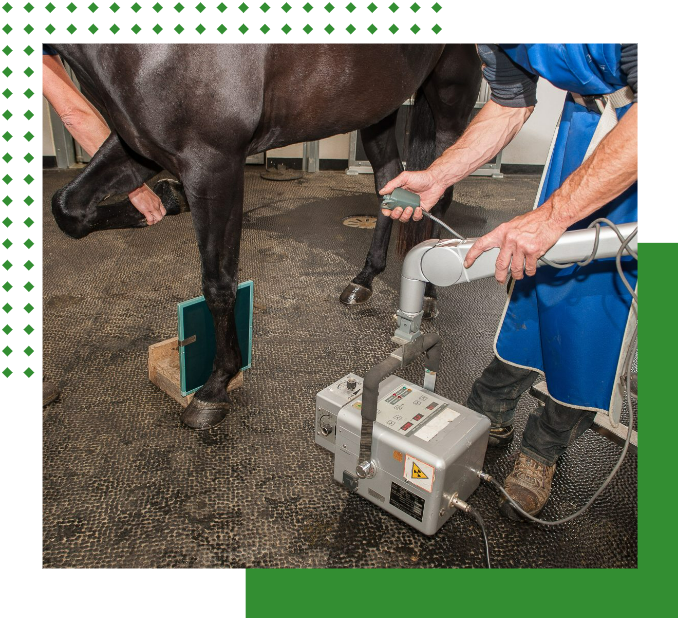

Carrazzo Consulting offers the experience and knowledge necessary to help you develop your successful veterinary practice. We work with a range of clinics from general practices to specialised equine and dairy clinics, meaning we have consultants to suit any need.

CARRAZZO CONSULTING

Our Veterinary Services

WE’RE HERE TO HELP

How Can Carrazzo Assist You

With Your Vet Clinic?

Simplify your life with Carrazzo Consulting. Avoid the headache of generalists who are unable to engage in veterinary accounting. As an experienced, specialised provider for this very niche industry, we have the knowledge and experience you want to help you take control of your expenses.

VETERINARY

What you need to know

-

Must a tax invoice show the amount of GST payable separately?

No. The tax invoice must show the GST inclusive price and need not show the GST separately if the GST payable is merely 1/11th of the GST inclusive price. If it is not 1/11th of the GST inclusive price, for example it is a mixed supply, the GST must be shown separately.

-

What should I consider in determining the business structure I should use?

The business structure used should be chosen having regard to the following:

What type of business is it (business income or personal services)?;

Who will be the principals?;

What assets does the professional and his family own?;

What debts does the professional have?;

Do the principals want to borrow money from the company?;

Are new partners to be admitted into the future?;

Marriage status (children, etc.) of the business owner?;

Rules of regulatory bodies?; and

How old are the principals? Is superannuation a significant issue?

-

A taxpayer in business acquires an ABN, but due to turnover and projected turnover is less than $75,000, chose not to register for GST. If that taxpayer turnover subsequently exceeds $75,000, must he or she register for GST immediately? Is GST payable?

The taxpayer must immediately register for GST when sales exceed $75,000. GST is payable on the sale proceeds, and tax credits can be claimed only from the date of registration.

Many small businesses will be caught out by this requirement. Accordingly, I strongly suggest that registration take place well in advance of the turnover exceeding $75,000 - at least 10% GST can be added to the sale prices, and the taxpayer will not be "out of pocket" for 1/11th of the sale proceeds.

-

Can GST registration be cancelled within 12 months of being registered?

Yes - a new law allows the ATO to cancel voluntary registration from as early as 1 July 2000, subject to certain conditions.

-

A taxpayer has two small businesses, each with an annual turnover of $30,000. As the turnover of each small business is under $75,000, does he or she have to register for GST?

Yes. If your total (or projected) annual turnover from all businesses is $75,000 or more, you must register for the GST. You do not look at each business in isolation. In terms of completing the BAS, the details of both businesses are consolidated by the entity.

-

Must a tax invoice show the amount of GST payable separately?

No. The tax invoice must show the GST inclusive price and need not show the GST separately if the GST payable is merely 1/11th of the GST inclusive price. If it is not 1/11th of the GST inclusive price, for example it is a mixed supply, the GST must be shown separately.

-

What tax rate does my superfund pay when I contribute deductible super contributions?

In last year's Budget, the government announced that, with effect from 1 July 2012, the rate of tax that applies to the concessional contributions for people with income above $300,000 would be increased from 15 percent to 30 percent.

If your income is less than $300,000 or less, the tax rate is only 15%.

-

What are reportable employer superannuation contributions?

Reportable employer superannuation contributions are contributions made by an employer under a salary sacrifice arrangement or contributions for an employee above the minimum amount required by law.

A reportable employer superannuation contribution for an individual for an income year is an amount contributed:

- by an employer of the individual, or an associate of the employer, for the individual to a superannuation fund or RSA

- to the extent that the individual has the capacity, or might reasonably be expected to have capacity to influence:

- the size of the amount, and/or

- the way the amount is contributed so that their assessable income is reduced

-

What is the timing for contributing superannuation for deductibility purposes?

The time an employer contribution is made is important because the employer can only deduct a contribution "for the income year in which you made the contribution".

The timing of a contribution is not only significant for an employer's deduction entitlement, but may also affect:

- When an employer's superannuation guarantee contribution is made

- A member's entitlement to a tax deduction for a year

- A member's liability to excess contributions tax

- Eligibility for a government co-contribution in year, and

- The inclusion of the contribution in a fund's assessable income for the year

The ATO view on when a contribution is made is that a superannuation contribution is made when the capital of the fund is increased. This may be when an amount is received, when ownership of an asset is obtained or when the fund otherwise obtains the benefit of an amount. In the ordinary case:

- A contribution in cash is made when received by the fund

- A contribution by EFT or internet banking is made when the amount is credited to the fund's bank account – this may occur sometime after the contributor has done what is necessary to effect the payment, and

- A contribution by cheque is made when the cheque is received by the fund, unless it is subsequently dishonored

-

Are any employees excluded from superannuation requirements?

The time an employer contribution is made is important because the employer can only deduct a contribution "for the income year in which you made the contribution".

The timing of a contribution is not only significant for an employer's deduction entitlement, but may also affect:

- When an employer's superannuation guarantee contribution is made

- A member's entitlement to a tax deduction for a year

- A member's liability to excess contributions tax

- Eligibility for a government co-contribution in year, and

- The inclusion of the contribution in a fund's assessable income for the year

The ATO view on when a contribution is made is that a superannuation contribution is made when the capital of the fund is increased. This may be when an amount is received, when ownership of an asset is obtained or when the fund otherwise obtains the benefit of an amount. In the ordinary case:

- A contribution in cash is made when received by the fund

- A contribution by EFT or internet banking is made when the amount is credited to the fund's bank account – this may occur sometime after the contributor has done what is necessary to effect the payment, and

- A contribution by cheque is made when the cheque is received by the fund, unless it is subsequently dishonored

-

How is the required superannuation calculated?

Employer superannuation support under this scheme is measured in terms of a percentage of an employee's notional earnings base/salary and wages. For the current year, the percentage of that base that must be contributed is 9.25%.

The government has announced changes that will gradually increase the superannuation guarantee rate (charge percentage) from 9% to 12% between the 2013-14 and 2019-20 years. We will publish updated guidance if these announced changes become law, given that the coalition have flagged the deferral of these increases by 2 years.

-

I am thinking of commencing business. In what circumstances do I need to pay employee superannuation under the Superannuation Guarantee Scheme?

The superannuation guarantee scheme is designed to encourage employers to provide a minimum level of superannuation support for employees.

Where an employer provides less than the required level of support, they will be liable to pay a non-deductible charge called the Superannuation Guarantee Charge (SGC).

An "employee" for superannuation guarantee purposes is anyone who is an employee at common law. Generally, the degree of control exercised by the "employer" over the "employee" and the degree to which the "employee's" services are an integral part of the "employer's" business will be significant whether an employer-employee relationship exists.

-

I elect to lodge my GST return monthly. Does this mean I must pay my FBT, PAYG etc monthly?

No. You look at each tax separately and pay it according to its own payment rules. Even though you will be lodging a BAS each month, you will not be completing the PAYG boxes if you only have to pay PAYG quarterly.

-

What types of Super Funds are there?

There are several different types of superannuation funds. The mains ones are:

- Employer / Corporate / Staff funds – (funds established by an employer for the benefit of their staff)

- Personal Funds

- Industry Funds

- Self-managed super funds

If you would like more information about the different types of super funds, speak to one of our Matrium Financial Advisers.

-

Can I withdraw the money that I have in super?

Usually, you are restricted from accessing your super money until you reach your preservation age. Your preservation age is based on your date of birth and ranges between 55 and 60. In very specific circumstances you may be able to access your super funds on compassionate grounds, however, these situations are limited. For more information talk to our financial adviser’s or go to the APRA website.

-

When can I access my super?

Generally, you can only access your super savings when you reach preservation age. This is to ensure your super savings are used for when you reach retirement.

Your ‘preservation age’ determines when you can access your money, even if you have not retired. It is based on your date of birth and ranges between 55 and 60.

Get in Contact

ABOUT US

Carrazzo Consulting provides high-quality accounting and tax advisory services. Our clients are typically successful, ambitious, and time-poor. They value our smart, practical advice, and trust us to safeguard their interests and assets.

DISCLAIMER: The information contained herein is intended to afford general guidelines on matters of interest. Accordingly, the information on this site is not intended to serve as legal, accounting, or tax advice. Carrazzo Consulting disclaims all warranties with regard to this information, including all implied warranties of merchantability and fitness for a particular purpose. In no event shall Carrazzo Consulting be liable for any special, indirect, or consequential damages or any damages whatsoever resulting from loss of use, data, or profits, whether in an action of contract, negligence, or other tortuous action, arising out of or in connection with the use or performance of this information.